From Traditional to Intelligent: The Future of the Automotive Wiring Harness Industry

Automotive wiring harnesses are essential components for automobiles, and demand is even greater for new energy vehicles. They form the network backbone of a vehicle's electrical circuits and serve as the electronic control system that provides power and signals to various electrical and electronic devices. They are the "blood vessels" and "nervous system" of the vehicle. Wiring harnesses primarily consist of wires, terminals, connectors, and sheathing. Automotive wiring harnesses are custom-made, with design and quality standards varying between OEMs and vehicle models.

The automotive wiring harness market is enormous, and my country holds significant potential. The electrification, intelligentization, and localization of vehicles are driving rapid growth in the domestic wiring harness market, with a projected market potential of 160 billion yuan. The rise of domestic auto brands is driving a continuous increase in the domestic production rate of automotive wiring harnesses. The global automotive wiring harness industry is currently dominated by foreign capital, while domestic auto brands have a high rate of domestic component procurement. The steady increase in their market share will undoubtedly create opportunities for the development of domestic wiring harness companies.

1: Overview of automotive wiring harness

(1)What is an automotive wiring harness?

An automotive wiring harness is the network backbone of a vehicle's electrical circuits. It is an electronic control system that provides power and signals to various electrical and electronic devices. It serves as the vehicle's "blood vessels" and "nervous system." Connecting various electronic and electrical components, it provides stable power and signal data, making it an indispensable system-level component in vehicle manufacturing. A wiring harness primarily consists of copper or aluminum cables, terminals, connectors, and sheathing. Automotive wiring harnesses are custom-made products, with design and quality standards varying between different OEMs and vehicle models.

(2)History of Automotive Wiring Harness Development

①Origin of Automotive Wiring Harnesses

The origins of automotive wiring harnesses can be traced back to the early 20th century. With the rapid development of the automotive industry, automotive wiring harnesses emerged as a crucial automotive accessory.

Early automotive wiring harnesses were primarily made by winding copper wire. With the continuous advancement of technology, these harnesses gradually evolved into harnesses composed of multiple strands of copper wire.

Since the 1960s, with the rapid development of electronic technology, the application of automotive wiring harnesses has become increasingly widespread, affecting a wide range of areas, including the vehicle's powertrain, control system, and lighting system.

Today, automotive wiring harnesses have become an indispensable component of modern vehicles, playing a vital role in ensuring the safe and stable operation of the vehicle.

②Development Stages of Automotive Wiring Harnesses

Early Stage: Automotive wiring harnesses primarily served simple electrical connections, primarily made of copper wire and insulating tape.

Development Stage: With the increasing electronicization of vehicles, wiring harnesses began to adopt multi-channel transmission technology, resulting in modular wiring harness designs.

Optimization Stage: To improve the reliability and safety of automotive electrical systems, wiring harnesses began to incorporate polymer materials and laser welding technology.

Intelligent Stage: With the advancement of autonomous driving and connected vehicle technologies, wiring harnesses began to incorporate high-speed transmission technology and sensor integration, achieving more efficient and intelligent electrical connections.

(3)Automotive Wiring Harness Industry Classification

Based on voltage, wiring harnesses can be divided into high-voltage and low-voltage harnesses. High-voltage harnesses operate at 60V and above (generally between 60V and 800V) and are primarily used for driving power transmission in new energy vehicles. Low-voltage harnesses operate below 60V (12V to 48V), typically used in vehicles with a 12V voltage, and are primarily used for signal transmission throughout the vehicle.

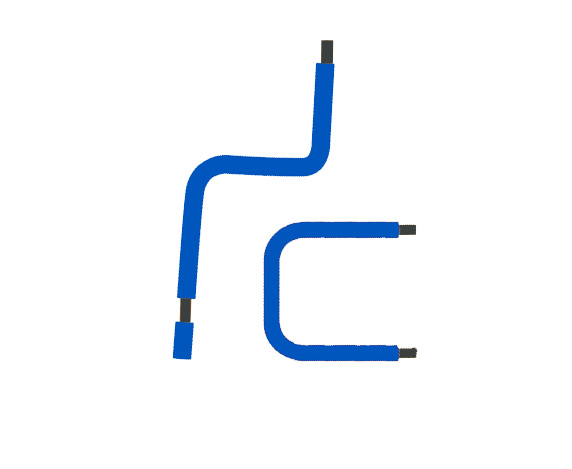

Based on their layout within the vehicle, wiring harnesses can be categorized as body assembly harnesses, engine harnesses, instrument panel harnesses, door harnesses, roof harnesses, chassis harnesses, and high-voltage harnesses.

Body assembly harnesses achieve contactless circuitry throughout the vehicle and control multiple loads in the system, eliminating wiring harness complexity and improving system reliability and safety.

Electronic fuel injection engine harnesses utilize a single bundle of common wires to transmit multiple signals, enabling control of multiple loads in the engine's electronic fuel injection system and eliminating wiring harness complexity.

Instrument panel harnesses offer extremely convenient assembly and improved processability.

The door control system wiring harness, by interfacing with the vehicle's wiring harness, enables functions such as power window lifts, heated and controlled mirrors, electric door locks, and speakers.

The roof wiring harness, by interfacing with the vehicle's wiring harness, enables functions such as the interior dome light, power sunroof, rain sensor, and ONSTAR.

The floor wiring harness connects all electrical components on the floor, including the four doors, parking brake, and seats, such as door switches, parking brakes, seatbelt warning systems, and seat adjustments.

The high-voltage wiring harness is specifically designed for new energy vehicles.

The high-voltage wiring harness is the primary carrier of power output in new energy vehicles. It is a completely new system driven by electrification, replacing the engine wiring harness in traditional vehicles. It primarily includes high-voltage connectors, high-voltage cables, and charging sockets.

2. Automotive wiring harness industry situation

(1)Automotive Wiring Harness Enterprise Layout

Overseas wire harness giants have a full industry chain presence, while domestic companies primarily focus on assembly.

Overseas giants possess full industry chain capabilities, while domestic companies have a presence across cables, connectors, and wiring harnesses, but no company has achieved a complete industry chain presence.

(2)High Barriers in the Automotive Wiring Harness Industry

The automotive wiring harness industry faces four major barriers: suppliers, technology, capital, and management. Management barriers are particularly significant. The automotive wiring harness production process is complex, with a total of 17 steps, making production management and cost control crucial.

The automotive wiring harness production process is complex, with a total of 17 steps.

(3)Automotive Wiring Harness Industry Chain

The automotive wiring harness industry's upstream and downstream supply chains encompass multiple links, including raw material supply, wiring harness manufacturing, and vehicle assembly. This article will analyze the automotive wiring harness industry chain from three perspectives: upstream raw materials, midstream manufacturing, and downstream applications.

①Upstream Raw Materials – Stable Supply

The main raw materials for automotive wiring harnesses include copper, aluminum, plastic, and rubber. Currently, the supply of these raw materials is relatively stable, with minimal price fluctuations. Labor costs account for approximately 12%-17% of total production costs, while raw materials account for 70%-80%. With the gradual recovery of the global economy and the continued prosperity of the automotive market, upstream raw material suppliers are continuously expanding their production capacity to meet market demand. At the same time, some raw material suppliers are actively developing new materials to improve the performance of automotive wiring harnesses and reduce costs.

②Midstream Manufacturing – Intense Competition

The manufacturing process of automotive wiring harnesses is the core of the entire industry chain. Currently, there are numerous domestic automotive wiring harness manufacturers, but most are small in scale and have varying levels of technological expertise. To gain a foothold in the market, some companies are increasing their R&D investment to improve product quality and performance. At the same time, some leading companies are expanding their production scale and increasing their market share through mergers and acquisitions. However, with intensifying market competition, cost pressures in the manufacturing process are also increasing.

③Downstream Applications - Diversified Demand

Downstream applications for automotive wiring harnesses primarily include traditional fuel-powered vehicles, new energy vehicles, and various commercial vehicles. With the continuous development of the automotive market, the demand for automotive wiring harnesses from these downstream applications has also diversified. Traditional fuel-powered vehicles primarily focus on basic electrical connections and signal transmission; new energy vehicles, on the other hand, place higher demands on high-voltage wiring harnesses and battery management system wiring harnesses. Commercial vehicles place greater emphasis on wiring harness reliability and durability. These diverse demands provide broad growth opportunities for the automotive wiring harness industry.

(4)The core logic of investment in the automotive wiring harness industry chain

①Electrification

New energy vehicles are driving the use of high-voltage wiring harnesses. Compared to traditional fuel-powered vehicles, new energy vehicles have higher drive voltages, requiring high-voltage wiring harnesses to connect various circuit components.

In new energy vehicles, high-voltage wiring harnesses are primarily used for five components: the power battery high-voltage wiring harness (connecting the power battery to the high-voltage junction box), the motor controller wiring harness (connecting the high-voltage junction box to the motor controller), the fast-charging wiring harness (connecting the fast-charging port to the high-voltage junction box), the slow-charging wiring harness (connecting the slow-charging port to the onboard charger), and the high-voltage accessory wiring harness (connecting the high-voltage junction box to the DC-DC converter, onboard charger, air conditioning compressor, and PTC).

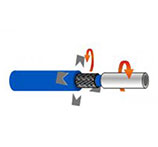

High-voltage wiring harnesses put forward new requirements for the wiring harness industry. New energy vehicles have higher requirements for wiring harness transmission capacity, mechanical strength, insulation protection and electromagnetic compatibility.

a.The rated power of the motor used in new energy vehicles can generally reach 150Kw. In order to minimize the energy loss during the transmission of current, the working voltage of the high-voltage electrical system must be increased. The driving voltage can generally reach about 550V-750V, and the fast charging voltage can even reach 800-1000V, which is much higher than the 12V voltage of fuel vehicles. Therefore, the wiring harness is required to have stronger pressure resistance and sealing to avoid the high-voltage line short circuit after the car encounters a collision and cause a combustion accident.

b. New energy vehicles use AC motors, which have strong electromagnetic interference. The design of new energy vehicle wiring harnesses must take electromagnetic interference into consideration to ensure the reliability of wiring harness application. c. The transmission of large currents will inevitably lead to excessive power consumption and heat. The design of high-voltage wiring harnesses must use materials that can withstand higher temperatures. The value of new energy vehicle wiring harnesses per vehicle has increased significantly. The high-voltage wiring harness system is a brand-new system under electrification, replacing the engine wiring harness of traditional vehicles. The value of each vehicle can reach 2,000 yuan, thereby driving the total average value of the wiring harness of new energy vehicles to more than 5,000 yuan per vehicle, and up to more than 10,000 yuan, which is significantly higher than the average level of 3,500 yuan for fuel vehicles.

②Intelligence

Smart cars are constantly upgrading. China actively encourages the development of the intelligent driving industry. The Ministry of Industry and Information Technology's "Intelligent Connected Vehicle Technology Roadmap 2.0" proposes that by 2025, the market share of PA (partially automated driving) and CA (conditionally automated driving)-level intelligent connected vehicles will exceed 50%, and HA (highly automated driving)-level intelligent connected vehicles will achieve commercial application in limited areas and specific scenarios. By 2030, the market share of PA and CA-level intelligent connected vehicles will exceed 70%, and the market share of HA-level intelligent connected vehicles will reach 20%, with widespread use on highways and large-scale deployment on some urban roads. Regarding driving comfort, the penetration of smart cockpit features such as large smart screens, head-up display (HUD), voice and gesture recognition, and heated seats and steering wheels is also increasing. These features all rely on wiring harnesses to ensure signal transmission.

Intelligent upgrades are driving increased wiring harness usage. With the increasing number of intelligent features in vehicles, the increasing sophistication and complexity of sensors and computing, and the trend towards software-defined vehicles, bandwidth requirements for data connections are rapidly increasing, exceeding the performance capabilities of traditional in-vehicle networks. According to data from the Economist, the average number of sensors currently installed in a car exceeds 90, with high-end models featuring 200. Increasing demands for safety and intelligent driving will drive continued growth in the number of automotive sensors, and thus in the use of wiring harnesses. Furthermore, the advancement of autonomous driving capabilities has created new requirements for high-speed data transmission, driving demand for high-speed data cables. High-frequency, high-speed automotive wiring harnesses are primarily used for cameras, sensors, antennas, GPS, Bluetooth, Wi-Fi, navigation, and assisted driving systems.

③Localization

The localization of automobiles will drive an increase in the localization rate of automotive wiring harnesses. Since 2020, the market share of Chinese domestically produced passenger cars has increased annually, reaching 56% by 2023. Domestic auto brands have a high rate of domestic parts procurement, and their steadily increasing market share will undoubtedly create development opportunities for domestic automotive wiring harness companies.

(5)Lightweight becomes the development direction

Lightweighting is a growing trend, but whether aluminum will gradually replace copper remains to be seen through technological advancements and market forces. Against the backdrop of increasingly stringent global environmental standards, automakers are vigorously promoting lightweight vehicle production to improve fuel efficiency.

Weight reduction improves fuel economy, handling stability, and crash safety, effectively improving vehicle quality. According to statistics, for every 10kg reduction in vehicle weight, a pure electric vehicle's driving range increases by 2.5km. The "Energy-Saving and New Energy Vehicle Technology Roadmap 2.0," released by the Ministry of Industry and Information Technology in 2020, states that by 2030, vehicle weight must be reduced by 35% compared to 2015 levels. As a key automotive component, automotive wiring harnesses account for 2%-3% of the vehicle's total mass, with automotive cables comprising 75%-80% of that weight. Based on the weight of a B-class sedan, the wires weigh approximately 25-30kg. Consequently, lightweighting automotive wiring harnesses has become a key breakthrough area.

With the rapid development of automotive electronics and information technology, the widespread use of in-vehicle electronic devices has led to increasingly long and complex electrical wiring. The increased weight of automotive wiring harnesses has also led to increased vehicle costs and energy consumption, making the goal of lightweighting wiring harnesses increasingly important.

The lightweighting of automotive wiring harnesses primarily focuses on three subcomponents: conductors, connectors, and harness protection. Specific optimization approaches include optimizing materials for power and signal cables, optimizing connector structures, and optimizing materials and designs such as replacing metal with plastic. Currently, copper is the primary raw material for cables and is a key area of weight reduction. In addition to using thin-walled conductors to reduce cross-sectional area, aluminum, a lower-cost and lighter material than copper, has become a hot research and development direction for lightweighting automotive wiring harnesses. Aluminum has a density of only 30% of copper. Once mature solutions are found for the issues of aluminum conductors' susceptibility to oxidation and unstable electrical and mechanical properties, lightweight aluminum wiring harnesses are expected to become the primary technology for automotive wiring harnesses.

It's understood that Tesla and the Xiaomi SU7 use aluminum wiring harnesses, while mainstream emerging domestic manufacturers use copper high-voltage wiring harnesses. Only Tesla has publicly advertised its use of all-aluminum high-voltage wiring harnesses. Industry experts generally believe that Tesla's use of aluminum wiring reduces weight by 21% compared to copper wiring of the same current carrying capacity, resulting in lower costs. Elon Musk has publicly touted Tesla's aluminum wiring harnesses as a cost-saving measure. Furthermore, Tesla's wiring harnesses are only about one-tenth the length of traditional wiring harnesses, resulting in both cost savings and weight reduction.

While both types of wiring have the same current carrying capacity, copper wiring weighs approximately twice as much as aluminum wiring. This, combined with the price difference between copper and aluminum, results in an equivalent copper wiring harness costing approximately seven times that of aluminum. It's worth noting that, given the relatively large cross-sectional area of aluminum wiring, aluminum-core cables require more insulation and protective materials, reducing their price advantage. Currently, the price of commonly used aluminum alloy cables is only about 75% of that of copper-core cables. If the same continuous current is required, 50 square copper wires can be replaced with 70 square aluminum wires. Even so, the weight can still be reduced by about 45% and the cost can be saved by more than half.

3. Competition situation in the automotive wiring harness industry

(1)Global Market Landscape

Currently, the global automotive wiring harness industry is dominated by foreign investment. High-voltage wiring harnesses contribute significantly to the growth, with the Chinese wiring harness market accounting for the majority of the growth. The top three companies hold 71% of the global automotive wiring harness market, with Yazaki, Sumitomo, and Aptiv accounting for 30%, 24%, and 17%, respectively. The Chinese automotive wiring harness market is projected to reach 81.46 billion yuan in 2022, a year-on-year increase of 5.5%. According to the China Economic Industry Research Institute, the top seven companies in the global wiring harness industry in 2021 were all foreign-funded. Currently, the global competitive landscape is dominated by German, Japanese, and American giants.

(2)Domestic Market

The domestic market is relatively fragmented, with a strong trend toward localized customers and a high proportion of overseas brands.

There are a large number of domestic automotive wiring harness manufacturers, most of which are small, with weak R&D capabilities, outdated production equipment, low quality, and a limited range of vehicle models. They primarily supply domestic automakers, with Tianhai and Huguang holding high market shares.

Foreign/joint venture brands offer advantages in high product quality and stable manufacturing, but they are priced higher. With the gradual development of domestic automakers and the increasing emphasis on cost control by international automakers, localized sourcing of auto parts is increasingly intensifying. Domestic brands have advantages in price and gross profit margins, and with close ties to domestic OEMs, they are capitalizing on the rapid development of new energy vehicles in China to seize market share. Some leading wiring harness companies, which have established brand influence in the high-end, high-quality wiring harness market, are accelerating their capital investment and integrating industry resources to leverage synergies with partners in technology, customer relationships, and supporting services. This creates significant potential for domestic substitution.

Supplier qualification requirements are stringent, and the industry faces a survival of the fittest. Automakers often establish strict certification and evaluation standards for automotive wiring harness suppliers. Generally speaking, automotive wiring harness companies seeking to enter an OEM's parts supply chain must not only obtain IATF16949 quality management system certification, as developed by the International Automotive Task Force, but also meet the OEM's specific standards and requirements regarding product quality, simultaneous development, logistics and transportation, management, cost control, and financial performance.

As the automotive industry develops, OEMs will impose increasingly stringent and complex requirements on automotive wiring harness products. Smaller, less powerful wiring harness companies will face a more challenging market environment. High-quality Chinese wiring harness companies will leverage their outstanding product quality and solid customer base to further expand their market share. In the future, my country's wiring harness industry will face an industry environment characterized by the survival of the fittest and accelerated resource integration.

The rise of domestically produced automobiles will drive an increase in the domestic content rate of automotive wiring harnesses. Since 2020, the market share of Chinese independent brand passenger cars has increased annually, reaching 56% by 2023. Independent auto brands have a high rate of domestic component procurement, and their steadily increasing market share will undoubtedly create opportunities for the development of domestic automotive wiring harness companies.

EC-6100 Automatic Heat Shrink Tube Cutting Machine EC-6800 Automatic Cutting Machine EC-6100H Automatic Hot Cutting Machine EC-830 Corrugated Tube Cutting Machine EC-6500 Automatic Cable and Tube Cutting Machine EC-810 Automatic Cable Cutting Machine EC-850X Automatic Rotary Cutting Machine EC-821 Corrugated Tube Cutting Machine EC-890 Multifunctional Automatic Cutting Machine EC-870 High-power Automatic Tube Cutting Machine EC-816 Automatic Cutting Machine EC-823 High Speed Cutting Machine EC-805 Automatic Cable Cutting Machine EC-860 Corrugated Tube Cutting Machine EC-830F Automatic Tube Cutting Machine With Feeding System EC-830FS Tube Cutting Machine With Feeding System EC-3100 Automatic Cable and Tube Cutting Machine

EC-6100 Automatic Heat Shrink Tube Cutting Machine EC-6800 Automatic Cutting Machine EC-6100H Automatic Hot Cutting Machine EC-830 Corrugated Tube Cutting Machine EC-6500 Automatic Cable and Tube Cutting Machine EC-810 Automatic Cable Cutting Machine EC-850X Automatic Rotary Cutting Machine EC-821 Corrugated Tube Cutting Machine EC-890 Multifunctional Automatic Cutting Machine EC-870 High-power Automatic Tube Cutting Machine EC-816 Automatic Cutting Machine EC-823 High Speed Cutting Machine EC-805 Automatic Cable Cutting Machine EC-860 Corrugated Tube Cutting Machine EC-830F Automatic Tube Cutting Machine With Feeding System EC-830FS Tube Cutting Machine With Feeding System EC-3100 Automatic Cable and Tube Cutting Machine CS-4507/6010 Multifunctional Wire Stripping Machine UniStrip 2016 Pneumatic Wire Stripping Machine UniStrip 2018E Electric Cable Wire Stripping Machine CS-5507 Automatic coaxial cable stripping machine CS-5515 Automatic coaxial cable stripping machine CS-400 Braided Shield Cable Stripping Machine CS Series Rotary Cable Stripping Machine CS-2486 Coaxial Cable Wire Stripping Machine

CS-4507/6010 Multifunctional Wire Stripping Machine UniStrip 2016 Pneumatic Wire Stripping Machine UniStrip 2018E Electric Cable Wire Stripping Machine CS-5507 Automatic coaxial cable stripping machine CS-5515 Automatic coaxial cable stripping machine CS-400 Braided Shield Cable Stripping Machine CS Series Rotary Cable Stripping Machine CS-2486 Coaxial Cable Wire Stripping Machine TM-20 Terminal Crimping Machine TM-20S Automatic Wire Terminal Crimping Machine TM-200 Terminal Crimping Machine TM-10P Registered Jack Crimping Machine TM-E140 Pre-insulation Ferrule Terminal Strip And Crimp Machine TM-E140S Automatic Wire Stripping Ferrule Crimping Machine TM-P300 Pneumatic Terminal Crimping Machine TM-E116 Electric Terminal Crimping Machine TM-P120 Pneumatic Terminal Crimping Machine SAT-AS6P Pneumatic Crimping Applicator SAT-MS6 Mechanical Crimping Applicator Side Feed Terminal Crimping Applicator Rear Feed Terminal Crimping Applicator Flag Terminal Crimping Applicator Crimp Applicator for Insulated Terminals TM-T Series Intelligent Servo Terminal Crimping Machine SAT-MS5 OTP Mechanical Applicator TM-25M Automatic Terminal Crimping Machine TM-FK40 Terminal Crimping Machine TM-CS6 Ultra Silent Copper Belt Crimping Machine

TM-20 Terminal Crimping Machine TM-20S Automatic Wire Terminal Crimping Machine TM-200 Terminal Crimping Machine TM-10P Registered Jack Crimping Machine TM-E140 Pre-insulation Ferrule Terminal Strip And Crimp Machine TM-E140S Automatic Wire Stripping Ferrule Crimping Machine TM-P300 Pneumatic Terminal Crimping Machine TM-E116 Electric Terminal Crimping Machine TM-P120 Pneumatic Terminal Crimping Machine SAT-AS6P Pneumatic Crimping Applicator SAT-MS6 Mechanical Crimping Applicator Side Feed Terminal Crimping Applicator Rear Feed Terminal Crimping Applicator Flag Terminal Crimping Applicator Crimp Applicator for Insulated Terminals TM-T Series Intelligent Servo Terminal Crimping Machine SAT-MS5 OTP Mechanical Applicator TM-25M Automatic Terminal Crimping Machine TM-FK40 Terminal Crimping Machine TM-CS6 Ultra Silent Copper Belt Crimping Machine ESC-BX1 Wire Cutting and Stripping Machine ESC-BX4 Wire Cutting And Stripping Machine ESC-BX30 Automatic Large Cable Cutting and Stripping Machine ESC-BX30S Sheathed Cable Automatic Cutting and Stripping Machine ESC-BXR Automatic Rotary Cable Stripping Machine ESC-BX6 Wire Cutting And Stripping Machine ESC-BX7 Wire Cutting And Stripping Machine ESC-BX8S Sheath Cable Cutting and Stripping Machine ESC-BX8PR Wire Cutting And Stripping Machine ESC-BX9 Automatic Cut and Strip Machine ESC-BX30SC Automatic Cable Wire Cutting and Stripping Machine ESC-BX120 Automatic Cutting and Stripping Machine ESC-BX30RS Multi-function Rotary Cable Stripping Machine ESC-BX120S Multi-core Cable Cutting and Stripping Machine ESC-BX60 Automatic Cable Cutting and Stripping Machine CS-9580 Automatic Coaxial Cable Stripping Machine CS-9680 Automatic Coaxial Cable Stripping Machine ESC-BX300 Automatic Cable Wire Cutting And Stripping Machine ESC-BX16 Wire Cutting Stripping Machine ESC-BX20SF Flat Twin Wire Cutting and Stripping Machine

ESC-BX1 Wire Cutting and Stripping Machine ESC-BX4 Wire Cutting And Stripping Machine ESC-BX30 Automatic Large Cable Cutting and Stripping Machine ESC-BX30S Sheathed Cable Automatic Cutting and Stripping Machine ESC-BXR Automatic Rotary Cable Stripping Machine ESC-BX6 Wire Cutting And Stripping Machine ESC-BX7 Wire Cutting And Stripping Machine ESC-BX8S Sheath Cable Cutting and Stripping Machine ESC-BX8PR Wire Cutting And Stripping Machine ESC-BX9 Automatic Cut and Strip Machine ESC-BX30SC Automatic Cable Wire Cutting and Stripping Machine ESC-BX120 Automatic Cutting and Stripping Machine ESC-BX30RS Multi-function Rotary Cable Stripping Machine ESC-BX120S Multi-core Cable Cutting and Stripping Machine ESC-BX60 Automatic Cable Cutting and Stripping Machine CS-9580 Automatic Coaxial Cable Stripping Machine CS-9680 Automatic Coaxial Cable Stripping Machine ESC-BX300 Automatic Cable Wire Cutting And Stripping Machine ESC-BX16 Wire Cutting Stripping Machine ESC-BX20SF Flat Twin Wire Cutting and Stripping Machine TM-200SC Automatic Strip and Weather Pack Terminal Crimp Machine TM-20SCM Automatic Cable Stripping and Crimping Machine TM-80SCS Servo Stripping and Crimping Machine TM-30SC Stripping and Crimping Machine TM-15SCE Electric Stripping and Crimping Machine TM-20SCS Servo Stripping and Crimping Machine TM-15SC Stripping and Crimping Machine

TM-200SC Automatic Strip and Weather Pack Terminal Crimp Machine TM-20SCM Automatic Cable Stripping and Crimping Machine TM-80SCS Servo Stripping and Crimping Machine TM-30SC Stripping and Crimping Machine TM-15SCE Electric Stripping and Crimping Machine TM-20SCS Servo Stripping and Crimping Machine TM-15SC Stripping and Crimping Machine ACC-101 Automatic Single-head Terminal Crimping Machine ACC-102A Fully Automatic Terminal Crimping Machine (Both Ends) ACC-102B Automatic Double Terminal Crimping Machine ACC-105 Fully Automatic Single-head End-dipping Tin Machine ACC-106 Fully Automatic 5-Wire Single-head End-dipping Tin Machine ACC-202UP Fully-automatic cut,strip,crimp,insert and Heat Heat-shrink tube machine ACC-308 (Both ends) Full automatic Soldering machine ACC-208 Fully Automatic Crimping Machine (Both Ends) ACC-508 Fully Automatic Twisting, Soldering and Crimping Machine ACC-608 Fully Automatic Flat Cable Cut Strip and Crimp Machine

ACC-101 Automatic Single-head Terminal Crimping Machine ACC-102A Fully Automatic Terminal Crimping Machine (Both Ends) ACC-102B Automatic Double Terminal Crimping Machine ACC-105 Fully Automatic Single-head End-dipping Tin Machine ACC-106 Fully Automatic 5-Wire Single-head End-dipping Tin Machine ACC-202UP Fully-automatic cut,strip,crimp,insert and Heat Heat-shrink tube machine ACC-308 (Both ends) Full automatic Soldering machine ACC-208 Fully Automatic Crimping Machine (Both Ends) ACC-508 Fully Automatic Twisting, Soldering and Crimping Machine ACC-608 Fully Automatic Flat Cable Cut Strip and Crimp Machine HSM-60 Heat Shrink Tube Processing Machine HSM-70 Heat Shrink Tube Processing Machine HSM-80B Heat Shrink Tube Processing Machine HSM-90 Heat Shrink Tube Processing Machine HSM-25M Heat Shrink Tube Processing Machine HSM-120 Heat Shrink Tube Heating Machine HSM-50 Heat Shrink Tube Processing Machine HSM-160 Heat Shrink Tube Processing Machine HSM-80A Heat Shrink Tube Heating Machine HSM-260E Enclosed Heat Shrink Tube Processing Machine HSM-260O Open Heat Shrink Tube Processing Machine HSM-20 Intelligent Heat Shrink Tube Processing Machine

HSM-60 Heat Shrink Tube Processing Machine HSM-70 Heat Shrink Tube Processing Machine HSM-80B Heat Shrink Tube Processing Machine HSM-90 Heat Shrink Tube Processing Machine HSM-25M Heat Shrink Tube Processing Machine HSM-120 Heat Shrink Tube Heating Machine HSM-50 Heat Shrink Tube Processing Machine HSM-160 Heat Shrink Tube Processing Machine HSM-80A Heat Shrink Tube Heating Machine HSM-260E Enclosed Heat Shrink Tube Processing Machine HSM-260O Open Heat Shrink Tube Processing Machine HSM-20 Intelligent Heat Shrink Tube Processing Machine HV-CS 9070 High-Voltage Cable Shield Cutting Machine HV-FS 9053 Cable Shield Folding Machine HV-ACS 9100 Cable Shield Processing Machine HV-ACS 9200 Automatic Cable Shield Processing System HV-ACS 9300 Automotive High Voltage Cable Processing Machine HV-ACS 9500 High Voltage Cable Processing Machine HV-FC 9312 Aluminum Foil Cutting Machine HV-CS 9120 Cable Stripping Machine

HV-CS 9070 High-Voltage Cable Shield Cutting Machine HV-FS 9053 Cable Shield Folding Machine HV-ACS 9100 Cable Shield Processing Machine HV-ACS 9200 Automatic Cable Shield Processing System HV-ACS 9300 Automotive High Voltage Cable Processing Machine HV-ACS 9500 High Voltage Cable Processing Machine HV-FC 9312 Aluminum Foil Cutting Machine HV-CS 9120 Cable Stripping Machine STB-10 Automatic Tape Bundling Machine STB-50 Desktop Bundling Machine STB-60 Adhesive Tape Bundling Machine STB-55 Desktop Tape Bundling Machine STB-50C Automatic Tape Cutting Machine STP-B Hand-held Taping Machine STP-F Hand-held Lithium Battery Tape Wrapping Machine STP-C Automatic Wire Taping Machine STP-D Automatic Tape Wrapping Machine STP-AS Automatic Tape bundling Machine

STB-10 Automatic Tape Bundling Machine STB-50 Desktop Bundling Machine STB-60 Adhesive Tape Bundling Machine STB-55 Desktop Tape Bundling Machine STB-50C Automatic Tape Cutting Machine STP-B Hand-held Taping Machine STP-F Hand-held Lithium Battery Tape Wrapping Machine STP-C Automatic Wire Taping Machine STP-D Automatic Tape Wrapping Machine STP-AS Automatic Tape bundling Machine CB-B15 Automatic Wiring Winding Machine CB-BT15 Automatic Wiring Winding Binding Machine CB-F30/150MCS Automatic Wiring Winding Machine CB-F30/150MCST18-45 Automatic Wiring Winding Binding Machine CB-F30/150MCST40-80 Automatic Wiring Winding Binding Machine CB-B15CST Automatic Wiring Coiling Binding Machine CB-F500MCS Automatic Wiring Winding Machine CB-B30/150CS Automatic Wiring Winding Machine CB-B10/15CS Automatic Wiring Winding Machine CB-WT630 Automatic Wire Winding and Tying Machine

CB-B15 Automatic Wiring Winding Machine CB-BT15 Automatic Wiring Winding Binding Machine CB-F30/150MCS Automatic Wiring Winding Machine CB-F30/150MCST18-45 Automatic Wiring Winding Binding Machine CB-F30/150MCST40-80 Automatic Wiring Winding Binding Machine CB-B15CST Automatic Wiring Coiling Binding Machine CB-F500MCS Automatic Wiring Winding Machine CB-B30/150CS Automatic Wiring Winding Machine CB-B10/15CS Automatic Wiring Winding Machine CB-WT630 Automatic Wire Winding and Tying Machine PF-08 Automatic Wire Prefeeder PF-30 Automatic Prefeeding Machine PF-60 Automatic Prefeeding Machine PF-150 Automatic Wire Prefeeding Machine CC-380 Cable Coiling Machine CC-680 Automatic Cable Coiling Machine CC-380D Cable Coil Machine PF-120 Large Automatic Wire Prefeeding Machine PF-90 Automatic Wire Prefeeder PF-100 Automatic Prefeeder PF-04 Automatic Wire Prefeeder PF-06 Automatic Wire Prefeeder PF-05 Automatic Wire Prefeeder

PF-08 Automatic Wire Prefeeder PF-30 Automatic Prefeeding Machine PF-60 Automatic Prefeeding Machine PF-150 Automatic Wire Prefeeding Machine CC-380 Cable Coiling Machine CC-680 Automatic Cable Coiling Machine CC-380D Cable Coil Machine PF-120 Large Automatic Wire Prefeeding Machine PF-90 Automatic Wire Prefeeder PF-100 Automatic Prefeeder PF-04 Automatic Wire Prefeeder PF-06 Automatic Wire Prefeeder PF-05 Automatic Wire Prefeeder

CHM-10 Crimp-Height Measurer PFM-220 Terminal Pulling Force Tester PFM-300 Terminal Pulling Force Tester PFM-200 Pull Force Tester For Wire Terminals TCA-120 Terminal Cross Section Analyzer TCA-120S Terminal Cross Section Analyzer TCA-150 Terminal Cross Section Analyzer PFM-50 Pull Force Measuring Machine

CHM-10 Crimp-Height Measurer PFM-220 Terminal Pulling Force Tester PFM-300 Terminal Pulling Force Tester PFM-200 Pull Force Tester For Wire Terminals TCA-120 Terminal Cross Section Analyzer TCA-120S Terminal Cross Section Analyzer TCA-150 Terminal Cross Section Analyzer PFM-50 Pull Force Measuring Machine